Managing budgets and forecasts can be one of the most time-consuming and challenging tasks for any business. Yet, it’s essential for staying on top of your finances and planning for growth. That’s where AI in budgeting and forecasting steps in.

By automating repetitive tasks, analysing data in real time, and offering insights you can act on, AI simplifies the process and helps you make informed financial decisions. Let’s explore how AI is reshaping the way businesses like yours handle financial planning.

What Comes To Mind When We Say AI?

When you hear the term AI, you might immediately think of tools like ChatGPT or Google’s AI-powered systems. These tools are well-known for generating text, answering questions, or assisting with everyday tasks. But AI has far broader applications, especially in the world of budgeting and forecasting.

In financial planning, AI tools are designed to simplify complex processes, reduce manual work, and provide insights that help businesses make better decisions. Some of the key capabilities include:

- Dynamic Budgeting: AI creates budgets that adapt as new data becomes available, ensuring your financial plans stay relevant.

- Scenario Planning: Simulate different financial scenarios to see how budget adjustments or unforeseen changes might impact your business.

- Cash Flow Forecasting: Generate accurate, real-time projections to anticipate upcoming opportunities or challenges.

- KPI Tracking: Monitor essential metrics to see how your budget aligns with your business goals and identify areas for improvement.

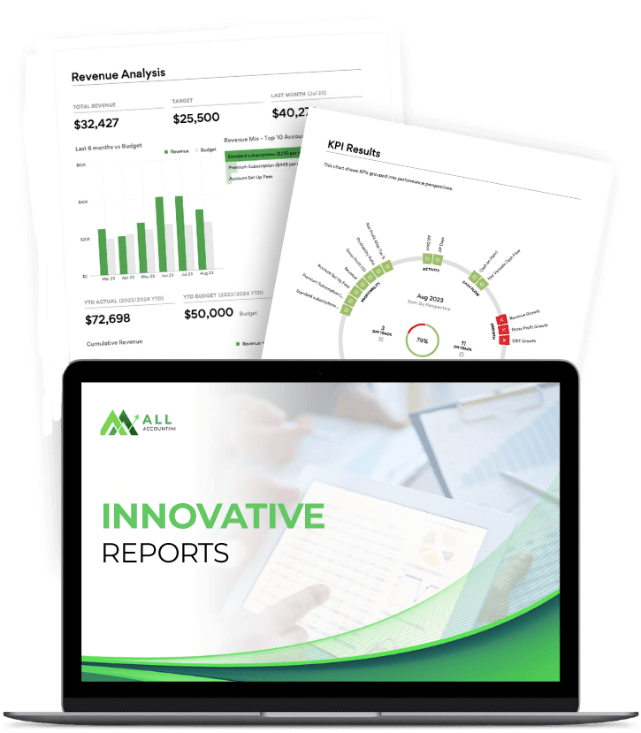

- Automated Reporting: AI produces clear and actionable financial reports, saving you time and providing valuable insights.

Instead of manually updating spreadsheets or relying on static numbers, AI empowers you to manage your budget and forecast with precision and flexibility. It enables you to respond quickly to market changes, allocate resources more effectively, and stay on top of your financial goals.

Curious to see these tools in action? Explore how our AI-Driven Reporting can transform your budgeting and forecasting process, offering tailored solutions to meet your business needs.

What Does AI In Budgeting And Forecasting Mean For Your Business?

AI in budgeting and forecasting refers to using advanced technologies like machine learning and predictive analytics to create more accurate and efficient financial plans. Instead of spending hours manually entering data or guessing at future trends, you can rely on AI to handle the heavy lifting.

For example, AI can analyse your historical data to spot patterns and trends that might not be immediately obvious. It then uses this information to create forecasts that adjust dynamically as new data comes in. Whether it’s planning for seasonal demand or anticipating cash flow needs, AI gives you the tools to stay ahead.

How AI Makes Budgeting And Forecasting Easier

AI doesn’t replace your role in financial planning—it works alongside you to make the process smoother and more effective. Here’s how:

Reducing Manual Work

Creating budgets and forecasts often involves tedious data entry and number crunching. AI automates these tasks, saving you hours and freeing up your time for more strategic decisions.

Providing Real-Time Updates

Unlike traditional methods, which rely on static data, AI updates your forecasts as new information becomes available. This means you’re always working with the most accurate numbers.

Offering Clear Insights

AI doesn’t just present data—it helps you interpret it. For instance, if your sales are trending higher than expected, AI can show you where to allocate additional resources to maximise your opportunities.

Why AI In Financial Forecasting Is Worth Considering

Using AI in financial forecasting isn’t about replacing your current methods—it’s about making them better.

Let’s say your business relies heavily on seasonal sales. AI can predict demand spikes based on past performance and external factors like market trends. This allows you to plan inventory, staffing, and marketing with confidence, avoiding overstocking or missing out on potential revenue.

By helping you anticipate challenges and opportunities, AI ensures you’re always prepared, even when the unexpected happens.

Practical Ways Businesses Are Using AI In Budgeting And Forecasting

AI is already making a difference for businesses across a range of industries. Here’s how:

- E-commerce: Predict sales patterns and adjust inventory in real time to meet customer demand.

- Technology: Forecast cash flow for R&D investments and project the potential return.

- Services: Monitor trends in expenses and revenue streams to optimise resource allocation.

No matter your industry, AI helps you make smarter financial decisions by providing insights tailored to your business needs.

How ALLI Accounting Supports Businesses With AI In Budgeting And Forecasting

At ALLI Accounting, we understand how important it is to have accurate and actionable financial plans. That’s why we use AI tools to take the guesswork out of budgeting and forecasting.

With our Virtual CFO Services, you’ll get:

- AI-driven insights to improve accuracy.

- Real-time updates to keep your forecasts current.

- Tailored strategies that align with your business goals.

Want to see the benefits for yourself? Try our AI-Driven Reporting Free Trial and discover how it can simplify your financial planning.

INTEGRATE SEAMLESSLY AND ELEVATE YOUR FINANCIAL MANAGEMENT

Optimise Your Success: Experience Our AI-Driven Reporting For Free

Start with a free trial to experience how our AI-enhanced insights can transform your financial data into actionable intelligence.

Plan Smarter With AI In Budgeting And Forecasting

AI in budgeting and forecasting helps you move beyond static spreadsheets and into a more dynamic, data-driven way of managing your finances. By embracing this technology, you’ll not only save time but also gain insights that make your financial decisions more precise and impactful.

Ready to see what AI can do for your business? Book a Call today, and let ALLI Accounting show you how to get started.

FAQs

How does AI improve financial forecasting?

AI uses real-time data and predictive analytics to create accurate forecasts that adapt as your business evolves. This makes your financial planning more reliable and effective.

Can AI work for small businesses?

Yes! AI tools are scalable and can be customised to meet the needs of businesses of all sizes, from start-ups to established companies.

What’s the difference between AI-driven forecasting and traditional methods?

AI-driven forecasting is dynamic, automated, and based on real-time data. Traditional methods rely on static information and manual processes, making them less adaptable.

How can I start using AI for my budgeting and forecasting?

The first step is to identify your financial planning needs. Then, explore tools or services like our AI-Driven Reporting to see how they can simplify your processes.

How do outsourced CFO services help improve budgeting and forecasting?

Outsourced CFO services provide expert insights and tools to enhance your budgeting and forecasting processes. They can identify key financial trends, integrate AI-driven solutions, and ensure your financial plans align with your business goals. Learn more about How Outsourced CFO Services Help You Effectively Track and Leverage KPIs for Business Growth.

How can profitability analysis support better forecasts?

A detailed profitability analysis helps identify areas of financial inefficiency, providing a clearer picture for accurate forecasting. AI tools can further streamline this process by automating profitability tracking and offering predictive insights. Explore our guide: Profit Mastery: Stopping the Bleed Through Comprehensive Profitability Analysis.

Should I use a fractional CFO for AI-driven budgeting and forecasting?

Fractional CFOs bring advanced financial expertise and can implement AI tools to create precise budgets and forecasts. They offer a flexible solution for businesses that need expert support without the cost of a full-time hire. Find out more in Fractional CFO vs. Full-Time Finance Executive: A Cost Comparison.

How can CFO advisory services improve financial forecasting?

CFO advisory services leverage advanced analytics and AI tools to make your forecasts more accurate and actionable. They provide detailed financial reports and offer strategies to help you stay on track. Learn more about Enhancing Financial Reporting Through CFO Advisory.

How does AI help fractional CFO services deliver better budgets and forecasts?

Fractional CFOs who use AI can create data-driven budgets and forecasts tailored to your business. AI tools provide real-time updates, predictive analytics, and actionable insights, simplifying the financial planning process. Read more in How Fractional CFO Services Can Help You Create and Manage Budgets and Forecasts for Business Success.

How does cash flow management tie into AI-powered forecasting?

AI-powered tools help monitor cash flow trends, predict potential shortfalls, and provide solutions for maintaining liquidity. CFO services can integrate these tools to ensure your cash flow aligns with your forecasts. Learn more about How CFO Services Can Transform Your Business Cash Flow Management.

How do AI tools help with budgeting and forecasting?

AI tools simplify budgeting and forecasting by automating manual tasks, analysing data in real time, and providing actionable insights. They allow businesses to create dynamic budgets and forecasts that adjust to changes in market conditions or internal performance. This ensures you’re always working with accurate, up-to-date financial information.

Want to understand more about the role of budgeting and forecasting in your business? Check out our blog on Understanding the Difference Between a Forecast and a Budget.

What financial tools can I use to complement AI in budgeting and forecasting?

AI works seamlessly with many financial tools to streamline budgeting and forecasting processes. Platforms like Xero integrate well with AI technologies, offering features such as automated data entry, real-time financial reporting, and predictive analytics. These tools make it easier to manage your finances and improve the accuracy of your forecasts while staying compliant with tax regulations.