Managing cash flow is one of the biggest challenges for growing businesses. Without enough cash on hand, it’s hard to pay bills, cover wages, or plan for the future—even if your business is making a profit.

This is where CFO services can help. By providing expert strategies, tailored advice, and real-time reporting tools, a CFO can help you take control of your cash flow, reduce risks, and plan for sustainable growth.

Why Cash Flow Management Matters

Cash flow management is about ensuring your business has enough money to operate and grow. Here’s why it’s so important:

1. Paying Bills And Employees On Time

Staying on top of cash flow means you can pay wages, suppliers, and bills when they’re due—keeping your operations running smoothly.

2. Avoiding Cash Shortages

Unexpected cash shortfalls can force you to borrow money, delay expenses, or cut corners. With proper cash flow planning, you can prepare for slow periods and avoid stressful surprises.

Example:

If a retail business expects slower sales after Christmas, accurate cash flow planning can help them reduce unnecessary spending and manage expenses in advance.

3. Planning For Growth

With better cash flow management, you can invest in new opportunities like hiring staff, buying equipment, or launching new products—without worrying about running out of money.

Common Cash Flow Challenges Businesses Face

Cash flow issues can derail even the most promising businesses. Here are some of the most common challenges business owners face:

- Late Payments from Customers: Waiting too long for customers to pay can create a cash crunch.

Solution: A CFO can implement improved invoicing systems and offer early payment incentives. - Unexpected Expenses: Sudden costs can leave you short on cash when you need it most.

Solution: Cash flow forecasting helps you anticipate and plan for unexpected expenses. - Overstocking Inventory: Holding too much inventory ties up cash that could be used elsewhere.

Solution: CFOs track sales trends to align inventory with actual demand. - Seasonal Sales Cycles: Many businesses experience peaks and troughs in revenue.

Solution: A CFO can smooth cash flow during slower months by adjusting budgets and payment terms.

How CFO Services Help You Manage Cash Flow

Working with a CFO—whether full-time or on a fractional basis—can transform how you manage cash flow. Here’s how:

1. Forecasting Cash Flow Accurately

A CFO helps you anticipate cash coming in and going out by analysing historical data and future projections.

Example:

An e-commerce business with seasonal spikes in sales can use cash flow forecasts to plan for stock purchases while keeping enough cash available to cover operational costs.

2. Reducing Unnecessary Spending

A CFO reviews your expenses and finds areas to save money without affecting the business.

Example:

A professional services firm might discover it’s paying for software licenses it no longer uses. A CFO helps cut those costs and reallocates the savings where they’re needed most.

3. Improving Payment Cycles

A CFO works with you to manage your receivables (money owed to you) and payables (bills you owe) more efficiently:

- Faster Payments: Streamline invoicing processes to get paid on time.

- Better Terms: Negotiate longer payment terms with suppliers to hold onto cash for longer.

Actionable Tips To Improve Your Business’s Cash Flow

Here are a few steps you can take right now to improve cash flow:

- Invoice Quickly: Send invoices as soon as work is completed or products are delivered.

- Offer Incentives for Early Payments: Small discounts can encourage faster customer payments.

- Negotiate Better Payment Terms with Suppliers: Extend payment deadlines to improve cash flow timing.

- Review Subscriptions and Recurring Costs: Cut unnecessary expenses that don’t add value.

- Track Cash Flow Regularly: Use tools like QuickBooks, Xero or AI dashboards to monitor cash inflow and outflow in real time.

While these tips help address short-term issues, CFO services offer deeper, long-term solutions to ensure steady cash flow.

Leveraging Technology For Better Cash Flow Insights

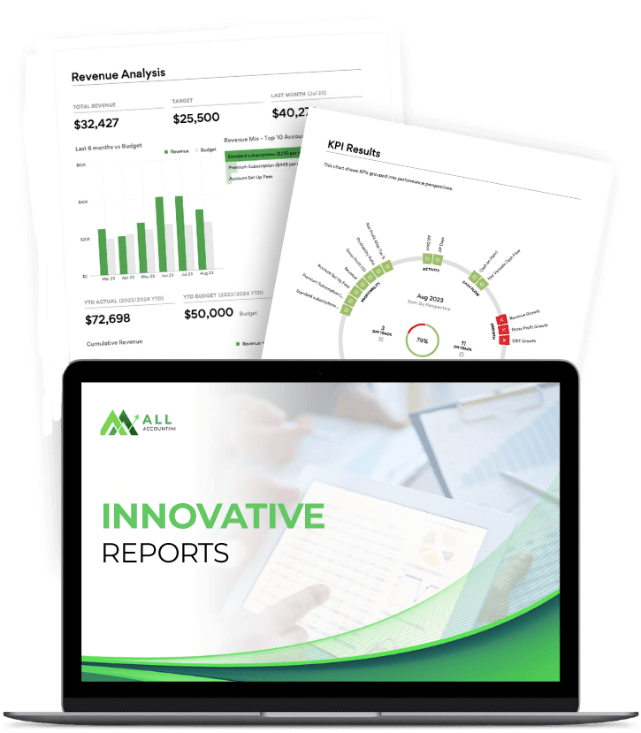

Today, CFO services combine financial expertise with advanced tools to provide clear, real-time insights into your cash flow.

Key Tools for Better Cash Flow Management

- QuickBooks Online & Xero: Track your income, expenses, and payments efficiently.

- Power BI: Build customised dashboards to monitor cash flow trends.

- ALLI Accounting AI Dashboards: Our AI-driven tools provide real-time updates, spot trends, and forecast cash flow accurately so you can plan ahead with confidence.

Example:

A manufacturing company using AI-powered dashboards can see exactly when supplier payments are due and align them with incoming cash from customers. This prevents shortfalls and keeps operations on track.

How CFO Services Transformed Cash Flow For A Growing Business

Now let’s look at an example of how CFO services can solve cash flow challenges and deliver measurable results.

The Challenge:

A medium-sized e-commerce company struggled with cash flow due to long customer payment cycles and overstocked inventory.

The Solution:

By engaging CFO services, the company:

- Streamlined invoicing and implemented early payment incentives.

- Reduced excess inventory by aligning purchases with real-time sales data.

- Forecasted cash flow trends to prepare for slower months.

The Results:

Within six months, the business:

- Improved cash collection by 30%.

- Freed up $50,000 in working capital.

- Reinvested savings into marketing, driving a 20% increase in revenue.

Questions To Ask A CFO About Improving Cash Flow

If you’re considering CFO services, here are a few questions to ask:

- How can we improve cash flow forecasting for my business?

- What tools will you use to track and manage cash flow?

- Where can we reduce unnecessary expenses?

- How can we shorten customer payment cycles?

- What strategies will you implement to help during seasonal slowdowns?

Asking these questions ensures you get a clear strategy for managing cash flow effectively.

Why Choose ALLI Accounting For CFO Services?

At ALLI Accounting, we specialise in CFO services designed to improve cash flow and set your business up for success.

- AI-Driven Reporting Tools: Real-time insights and accurate forecasts.

- Tailored Advice: Solutions designed specifically for your business.

- Proactive Strategies: We help you plan ahead and address cash flow challenges before they become problems.

INTEGRATE SEAMLESSLY AND ELEVATE YOUR FINANCIAL MANAGEMENT

Optimise Your Success: Experience Our AI-Driven Reporting For Free

Start with a free trial to experience how our AI-enhanced insights can transform your financial data into actionable intelligence.

Ready To Solve Your Cash Flow Challenges?

Improving cash flow can make all the difference in how you run your business. At ALLI Accounting, our CFO services combine financial expertise and innovative tools to give you clarity, control, and confidence.

Book a call today to learn how we can help you keep cash flowing and your business growing.

FAQs

How can CFO services improve my cash flow?

A CFO helps you forecast cash flow, reduce unnecessary expenses, and improve payment cycles to ensure steady cash availability.

What tools do CFOs use to track cash flow?

CFOs use tools like QuickBooks Online, Power BI, and AI-powered dashboards for real-time tracking and forecasting.

What’s the difference between CFO services and accounting services?

CFO services focus on strategy and cash flow management, while accounting services handle compliance and record-keeping.

How do CFO services help during seasonal slowdowns?

A CFO prepares cash flow forecasts and strategies to manage expenses and payments during quieter months.

How do CFO services help during slow revenue periods?

A CFO creates cash flow strategies to manage expenses, negotiate payment terms, and keep cash available when revenue slows.

How can I improve profitability alongside cash flow?

Download our free guide: Profit Mastery: Stopping the Bleed Through Comprehensive Profitability Analysis.

How can CFO advisory improve financial reporting for my business?

CFO advisory helps you create clear, compliant, and actionable financial reports that align with your goals. By leveraging advanced tools like AI-driven dashboards and expert analysis, a CFO turns complex financial data into insights you can use to drive growth and make better decisions. Learn more about Enhancing Financial Reporting Through CFO Advisory and how it can add value to your business.

How can outsourced CFO services help my business track and improve KPIs?

Outsourced CFO services focus on identifying, tracking, and analysing the right KPIs (Key Performance Indicators) for your business. With advanced tools and strategic insights, a CFO ensures you monitor metrics like cash flow, profit margins, and customer retention to make smarter, data-driven decisions. Learn more about How Outsourced CFO Services Help You Effectively Track and Leverage KPIs for Business Growth to take control of your performance metrics.

What are chief financial officer services, and how can they help my business?

Chief financial officer services provide businesses with strategic financial leadership, including cash flow forecasting, budgeting, and cost management. By analysing your finances and implementing tailored strategies, a CFO helps you manage cash flow effectively and make smarter financial decisions.

Why should I choose accounting firm CFO services over a full-time hire?

Choosing accounting firm CFO services gives you access to expert financial leadership without the cost of hiring a full-time CFO. This flexible option allows you to benefit from customised cash flow strategies, advanced reporting tools, and actionable insights while staying within your budget. Learn more in our blog: Fractional CFO vs. Full-Time Finance Executive: A Cost Comparison.