Creating and managing budgets and forecasts is crucial for running a successful business, but it’s not always straightforward. For many small to medium-sized businesses, the process can feel overwhelming—leading to overspending, missed opportunities, or unexpected cash flow challenges.

A Fractional CFO brings the expertise to simplify this process. They work alongside you to build realistic budgets, provide accurate forecasts, and offer actionable advice that helps you make smarter financial decisions and plan with confidence.

What Are Fractional CFO Services?

Fractional CFO services provide businesses with high-level financial expertise on a flexible, as-needed basis. You get the benefits of a CFO’s knowledge and experience without the cost of hiring a full-time executive.

What A Fractional CFO Does

- Budget Planning: Helps you allocate resources effectively to hit your goals.

- Forecasting: Provides data-driven projections to prepare for future growth and challenges.

- Cash Flow Management: Ensures you have the cash you need to cover expenses and plan ahead.

- Financial Reporting: Delivers clear reports that track progress and measure success.

These services are ideal for businesses looking for cost-effective solutions while still accessing the skills of a seasoned financial professional.

Why Are Budgets And Forecasts Important For Your Business?

Budgets and forecasts aren’t just for large corporations—they’re crucial tools for businesses of all sizes. Here’s why:

1. Better Decision-Making

Budgets show you how much you can afford to spend, and forecasts help you plan for what’s ahead.

Example: If your forecast predicts lower revenue next quarter, you can reduce spending now to protect your cash flow.

2. Resource Allocation

By creating a detailed budget, you can allocate funds to areas that drive the most growth, like marketing or operations.

3. Identifying Risks Early

Forecasting highlights cash flow gaps or unexpected expenses, giving you time to address them before they become problems.

4. Measuring Progress

Budgets help you track your actual spending against planned goals, making it easier to adjust when needed.

How Fractional CFO Services Improve Budgeting And Forecasting

Partnering with a fractional CFO gives you access to expert strategies and tools that improve the accuracy and value of your budgets and forecasts. Here’s how:

1. Creating Realistic Budgets

A fractional CFO works with you to understand your business goals and create budgets that reflect your needs.

Example: If you run a retail business, your CFO will factor in seasonal sales fluctuations to create a realistic budget for inventory and staffing.

2. Providing Accurate Forecasts

Using historical data and industry trends, a CFO delivers accurate forecasts that prepare you for both opportunities and challenges.

Example: For a technology company, your CFO can forecast cash flow to prepare for upcoming R&D investments.

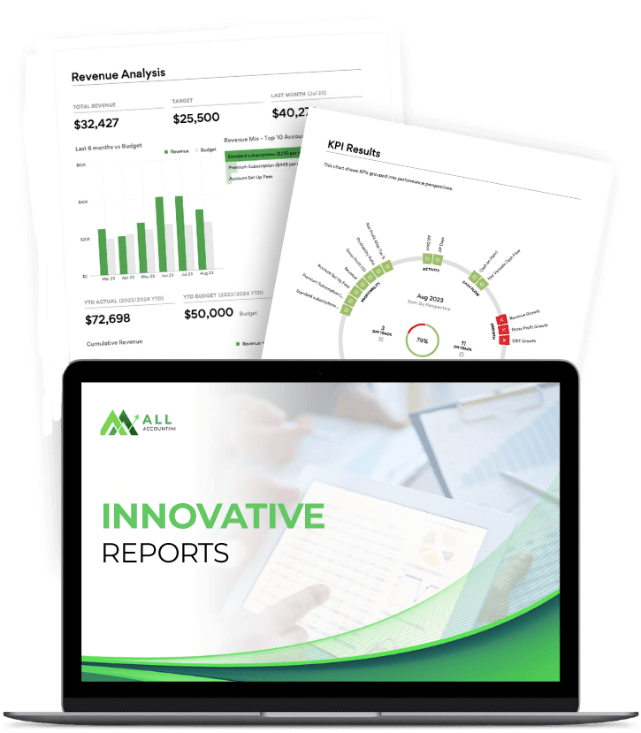

3. Using Advanced Tools And AI-Driven Reporting

At ALLI Accounting, we use AI-driven dashboards to simplify budgeting and forecasting. These tools provide:

- Real-Time Insights: Track cash flow, expenses, and revenue as they happen.

- Predictive Analytics: Identify trends and opportunities before they emerge.

- Customisable Reports: See exactly the data that matters to your business.

INTEGRATE SEAMLESSLY AND ELEVATE YOUR FINANCIAL MANAGEMENT

Optimise Your Success: Experience Our AI-Driven Reporting For Free

Start with a free trial to experience how our AI-enhanced insights can transform your financial data into actionable intelligence.

Practical Benefits of Working With a Fractional CFO

Here are the key ways fractional CFO services can benefit your business:

1. Save Time and Money

You’ll get expert support without the high salary costs of a full-time CFO.

2. Improve Cash Flow

CFOs manage cash flow forecasts to help you avoid shortages and make smarter spending decisions.

3. Align Budgets With Business Goals

Your CFO ensures your budgets and forecasts match your growth strategy.

Example: A service-based business planning to hire new staff can use a detailed forecast to determine how much they can afford to invest.

How Part-Time CFO Services Delivered Results

Let’s look at how part-time CFO services can improve budgeting and forecasting for businesses:

The Challenge:

A medium-sized e-commerce company lacked accurate budgets and struggled to predict cash flow, leading to overspending on inventory.

The Solution:

By working with fractional CFO services, the company:

- Created monthly budgets aligned with their sales targets.

- Implemented cash flow forecasts to prepare for slower months.

- Used AI dashboards to track performance in real time.

The Results:

- Reduced unnecessary spending by 25%.

- Improved cash flow stability within three months.

- Increased profitability by reallocating funds to marketing efforts.

How To Get Started With Fractional CFO Services

If you’re ready to improve your budgeting and forecasting, here’s how to get started:

- Define Your Goals: Outline your business priorities, like reducing costs or improving cash flow.

- Schedule a Consultation: Meet with a fractional CFO to discuss your needs. Book a call to get started.

- Implement Tools and Strategies: Work with your CFO to build budgets, forecasts, and reporting systems.

- Track and Adjust: Regularly review your financial plans to ensure you’re on track.

Why Choose ALLI Accounting For Fracitional CFO Services?

At ALLI Accounting, we specialise in fractional CFO services tailored to your business needs. Here’s what we offer:

- AI-Driven Tools: Our dashboards simplify budgeting and forecasting with real-time insights.

- Custom Solutions: We align financial strategies with your business goals.

- Proven Expertise: Our team has experience working with businesses across industries like e-commerce, retail, and technology.

Looking for more than just CFO services? Learn more about our accounting and bookkeeping services.

Ready To Take Control Of Your Budgets And Forecasts?

Managing budgets and forecasts doesn’t have to be complicated. With fractional CFO services, you’ll gain the tools, insights, and confidence you need to grow your business.

Book a call today to find out how ALLI Accounting can help you create smarter budgets and forecasts for success.

FAQs

How can part-time CFO services help with budgeting?

A part-time CFO works with you to create accurate budgets that align with your goals, ensuring you allocate resources effectively without overspending.

What tools do part-time CFOs use for forecasting?

CFOs use tools like AI-powered dashboards, QuickBooks Online, Xero and custom reporting systems to deliver accurate cash flow forecasts.

Why are forecasts important for small businesses?

Forecasts help businesses prepare for growth, anticipate cash flow gaps, and make informed decisions based on real data.

How do fractional CFO services compare to full-time CFOs?

Fractional CFOs provide flexible, cost-effective solutions for businesses that need expert guidance without the high overhead costs. Learn more in our blog: Fractional CFO vs. Full-Time Finance Executive: A Cost Comparison.

How can I improve profitability in my business?

Improving profitability starts with understanding where your business is losing money and identifying opportunities for growth. By analysing your expenses, pricing strategies, and profit margins, you can take actionable steps to boost profitability. Download our free guide: Profit Mastery: Stopping the Bleed Through Comprehensive Profitability Analysis to get expert tips on maximising your profits.

How can CFO advisory services enhance financial reporting?

CFO advisory services transform financial reporting into a strategic tool for growth. By delivering clear, accurate reports and actionable insights, a CFO helps you identify opportunities, reduce risks, and make smarter financial decisions. Learn more about Enhancing Financial Reporting Through CFO Advisory and how it can add value to your business.